China is a popular shopping destination for international travelers. To encourage tourism and spending, China offers a tax refund policy that allows visitors to claim back part of the Value-Added Tax (VAT) on eligible purchases when leaving the country. This guide provides a detailed explanation on how to apply for tax refunds in China, covering eligibility, process, duty-free shopping, and frequently asked questions. We hope this guide will help you understand the refund process and make the most of your shopping experience.

Eligible Countries/Regions

The tax refund policy applies to all non-residents of mainland China. Specifically, foreign passport holders who are visiting China for a short period (staying less than 183 days) are eligible to claim the refund.

Requirements to Qualify for a Refund

Duty-free stores are available in major airports, large shopping malls, and customs zones in China, where visitors can purchase goods without paying VAT. Common duty-free products include cosmetics, perfumes, luxury goods, electronics, and more. Some duty-free stores, like Apple stores, allow you to both enjoy tax-free shopping and process your tax refund at the same time.

The Relationship Between Duty-Free Shopping and Tax Refunds

Although you don’t pay VAT when purchasing items in duty-free stores, you still need to complete the tax refund process when departing. Even if you’ve bought items in a duty-free store, you can still submit a tax refund application at the airport.

How to Get a Tax Refund Form at a Duty-Free Store

The store will provide a tax refund form during your purchase. Be sure to ask for the form and keep all relevant receipts.

How do I know if my duty-free items qualify for a tax refund?

Duty-free products are typically labeled with “Tax-Free” on the price tags. If you’re unsure, it’s best to ask the store staff.

Is there a minimum purchase amount for tax refunds?

Yes, the minimum purchase for tax refunds in a single store on the same day is RMB 500.

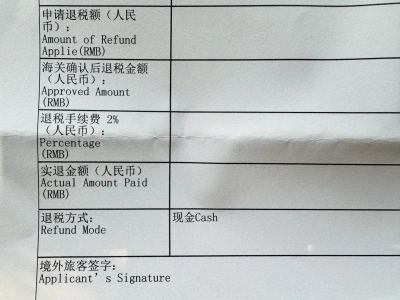

Tax refund amounts are based on VAT, which in China is generally 13% for most consumer goods. Visitors can claim up to 11% of the VAT paid on items purchased. For some items with a VAT rate of 9%, the maximum refund is 8%.

It is important to note that tax refund points charge a 2% handling fee. Therefore, the actual refund amount you will receive is 9% or 6%, depending on the VAT rate of the item.

Cash/Alipay/WeChat Refund

If your tax refund amount is under RMB 10,000, you can choose cash, Alipay, or WeChat refund at the airport. Cash refunds are processed immediately on-site.

Credit/Debit Card Refund

For refunds exceeding RMB 10,000, the refund can only be processed to your credit or debit card. The refund will be credited to your card within 14 to 22 working days.

What documents are required to apply for a tax refund?

You’ll need to provide your passport, shopping invoices, tax refund forms, and boarding passes when applying for a refund at the airport.

What if I don’t complete the tax refund at the airport?

You can choose other refund points, such as at ports, but the airport is usually the most convenient and efficient location.

Do the city of purchase and the city for the tax refund have to be the same?

No. For example, if you buy goods in Beijing, you can process your tax refund in Shanghai.

How do I find the tax refund counter at the airport?

The tax refund counter is typically located in the international departure area. Make sure to check the airport’s refund process before your trip.

What if I miss the tax refund deadline?

If you miss the deadline, your refund application will be invalid, and you won’t be able to claim your refund.

Can I still claim a refund if I didn’t bring all the items listed on the refund form?

No. According to the rules, customs will verify the actual items and match them with the quantity listed on your tax refund form before stamping it.

Do I have to process the tax refund immediately when leaving China?

No, you can process the tax refund at any time within 90 days from the purchase date, as long as the goods are taken out of China within that time frame.

The peak shopping seasons in China include major holidays such as Chinese New Year (January to February) and National Day (October 1-7). During these times, many stores offer discounts and promotions, so it’s a great opportunity to take advantage of even more savings.

In addition to airports, many high-end shopping centers and tourist areas feature duty-free shopping. Visitors can enjoy tax-free shopping at these locations as well.

For comprehensive information on tax refund procedures at all airports, please visit our Airport Tax Refund Guide Collection, where you’ll find specific details for major airports across China.

English (Hong Kong)

English (Hong Kong)